Financial Planning

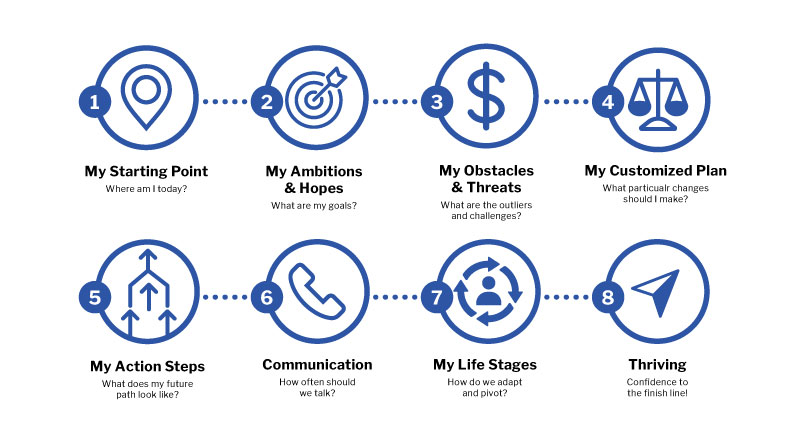

The complexities that come with significant wealth call for far-reaching care that frees you from the burdensome day-to-day management of your investments. Working closely with a wealth manager experienced in serving distinctive individuals, families and businesses enables you to spend your time where it matters most.

As we listen to you, we learn about your objectives, your perspective on risk and your liquidity needs. We then devise a plan to support your personal goals through professional investment management and strategic planning.

Using the details you have confided in us and our access to high-caliber research and analysis, we narrow down a selection of investments and an allocation tailored to your financial life. We will then present our recommendations and outline the steps needed to implement your plan.

Once you have approved the plan, we put it into action by choosing investment vehicle types and services uniquely suited to your needs, goals and risk tolerance. We craft your portfolio carefully, making the most of the choices available to serve your precise situation.

After establishing your plan, we continue to monitor its progress toward your objectives and ensure it keeps working for you through all of life’s changes, continually updating you and providing ongoing support. We stay abreast of what’s ahead, helping you remain equipped for the challenges of tomorrow.

Out of every check , as soon as possible as compounding of time and money is powerful. Adding 10 years to your accumulation time can double your values.

Lack of spending control is probably the biggest problem I see towards financial independence. Be clear about a want and a need.

Don’t “time” your investing based on your outlook and sentiment for the future. Missing the best 20 days over 20 years in stocks reduces your returns substantially from 9% to 5.5% annually. The worst case scenario almost never happens. Since 1928, US Stocks have been positive 76% of the time annually. This is nothing like gambling.

Just like a workout, you probably won’t be objective and honest on your own.

You must own it 100%.

Unreconciled issues are hard to recover from emotionally, spiritually, and financially.

Health care costs are going up much faster than inflation. Bad health has many ramifications.

Call (425) 212-2082

Check the background of your financial professional on FINRA’s BrokerCheck.

Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Investment advisory services are offered through Raymond James Financial Services Advisors, Inc. Constellation Wealth Services is not a registered broker dealer and is independent of Raymond James Financial Services.

Raymond James financial advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.

FINRA · SIPC · Privacy Policy